Understanding Oil Market Dynamics

As a beginner in the world of oil investments, grasping the factors that influence oil prices and investment returns is crucial. This guide will walk you through the key elements that shape the oil market and impact your potential for building passive income.

Supply and Demand: The Foundation

At its core, oil prices are driven by the basic economic principle of supply and demand. When demand outpaces supply, prices tend to rise, and vice versa. As an investor, understanding these fluctuations is key to making informed decisions.

Factors Affecting Supply:

- OPEC production decisions

- Geopolitical events in oil-producing regions

- Technological advancements in extraction

- Natural disasters affecting production facilities

Factors Affecting Demand:

- Global economic growth

- Seasonal variations in energy consumption

- Adoption of alternative energy sources

- Government policies and regulations

Geopolitical Influences

The oil market is highly sensitive to global political events. Tensions in oil-producing regions, trade disputes, and international agreements can all cause significant price fluctuations. Staying informed about world events is crucial for anticipating market movements.

Currency Exchange Rates

Oil is typically priced in US dollars. Therefore, changes in currency exchange rates can affect oil prices and, consequently, your investment returns. A weaker dollar generally leads to higher oil prices, while a stronger dollar can cause prices to fall.

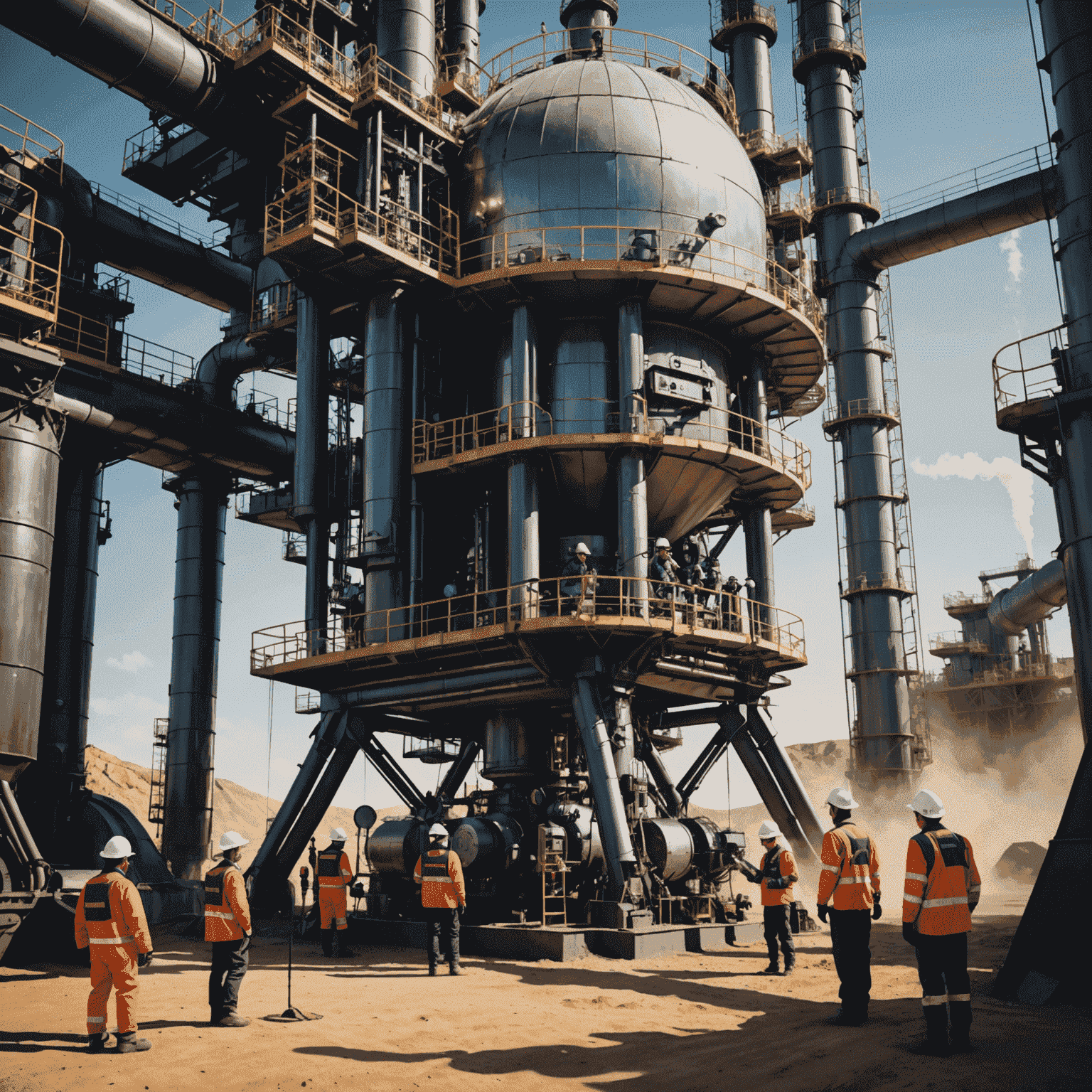

Technological Advancements

Innovations in drilling and extraction technologies, such as fracking, can significantly impact oil supply and prices. Keeping abreast of technological developments in the industry can provide valuable insights for your investment strategy.

Environmental Policies

As the world shifts towards cleaner energy sources, environmental regulations and policies can have a substantial impact on oil demand and prices. Understanding these trends is essential for long-term investment planning.

Investment Vehicles

There are various ways to invest in oil, each with its own risk profile and potential returns:

- Oil company stocks

- Oil ETFs (Exchange-Traded Funds)

- Oil futures contracts

- Master Limited Partnerships (MLPs)

Understanding these investment options and how they relate to oil market dynamics is crucial for building a successful passive income strategy in the oil sector.

Conclusion

The oil market is complex and influenced by a myriad of factors. As a beginner investor looking to build passive income through oil investments, it's essential to stay informed about these dynamics. Regular research, analysis, and a diversified approach can help you navigate the volatility of the oil market and work towards your financial goals.

Remember, while oil investments can offer significant returns, they also come with risks. Always consult with a financial advisor before making investment decisions.